Ressio + QuickBooks Online Integration FAQ: Understanding How Data Syncs Across Platforms

Learn how Ressio and QuickBooks Online share financial data — what syncs automatically, what doesn’t, and how to keep your books clean.

Overview

This guide explains how Ressio and QuickBooks Online (QBO) exchange information — specifically for accountants, bookkeepers, and financial professionals.

You’ll learn how each platform fits into your financial workflow, which data syncs in each direction, and how to maintain accurate records while empowering your project teams to work confidently inside Ressio.

👋 Who This Article Is For:

Accountants, controllers, and bookkeepers who manage financial workflows and need to understand how Ressio connects with QuickBooks Online.

Table of Contents:

- How the Integration Works

- Data Flow at a Glance

- What Syncs From QBO --> Ressio

- What Syncs From Ressio --> QBO

- What Doesn't Sync

- Best Practices for Accountants

How the Integration Works

The Ressio + QBO integration allows project and financial data to stay aligned across both systems.

-

For Invoice ONLY, Ressio communicates with QBO every 15 minutes (or on-demand when you trigger a manual sync).

-

Data moves directionally — some data flows one way, while others sync both ways depending on use case.

-

QuickBooks remains the master for accounting data such as vendor records, expenses, and payments.

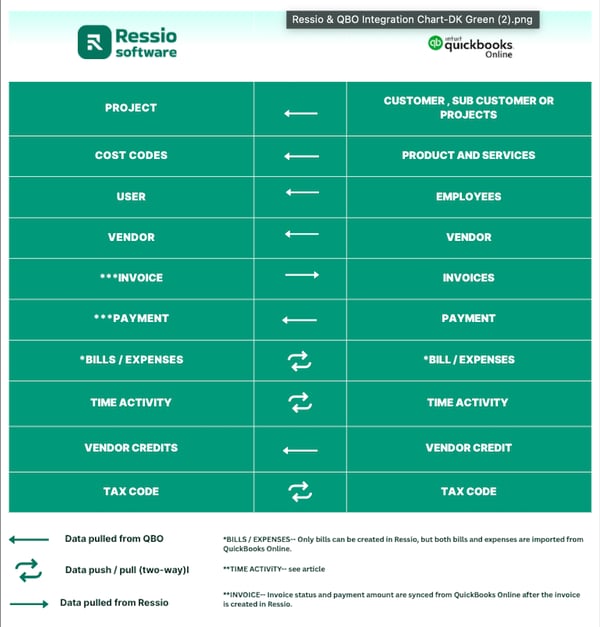

Data Flow at a Glance

This chart shows how key data types move between Ressio and QBO:

- ⬅️ Pulled from QBO — Imported into Ressio

- 🔁 Two-way sync — Data can flow in both directions

- ➡️ Pushed from Ressio — Created in Ressio and sent to QBO

⚠️Time tracked in QuickBooks Online can be pulled into Ressio, and time tracked in Ressio can be pushed into QuickBooks Online.

To sync time between the two systems, the employee must be listed as “On Payroll” in QuickBooks Online.

Attachments, such as receipts or invoices, do not sync between the systems.

💡 Key Notes

-

Bills / Expenses — Only bills can be created in Ressio, but both bills and expenses are imported from QBO.

-

Invoices (Client Invoices)—Created in Ressio and pushed to QBO; payment status and amount sync back automatically.

-

Time Activity — Time tracked in QBO can be pulled into Ressio, and time tracked in Ressio can be pushed into QBO.

- Vendor Credits — Pulled from QBO for visibility in Ressio.

- Tax Codes — Synced both ways for consistent rate application and reporting.

What Syncs From QBO → Ressio

| Data Type | Description |

| Customers / Projects | QBO customer (and sub-customers) appear as projects in Ressio. |

| Cost Codes / Products & Services | Imported for mapping budgets and client invoices. |

| Users / Employees | Pulled in for job costing and time tracking. |

| Vendors | Maintains consistency between both systems. |

| Payments (for Invoices) | Payment details flow into Ressio after the invoice syncs to QBO. |

| Bills / Expenses | Imported from QBO for cost tracking and visibility in project budgets. |

| Time Activity | Synced both ways; time entries are mirrored for accuracy. |

| Vendor Credits | Pulled from QBO for visibility and reporting |

| Tax Codes | Synced both ways for accurate tax rate application. |

What Syncs From Ressio→ QBO

| Data Type | Description |

| Client Invoices | Created in Ressio and pushed to QBO. Payment updates sync back from QBO automatically. |

| Bills | Created in Ressio and synced to QBO for accounting. |

| Time Activity | Time tracked in Ressio can be pushed to QBO for payroll and cost tracking. |

| Tax Codes | Two-way sync keeps rates consistent between both systems. |

What Doesn't Sync

Some data remains exclusive to either platform to maintain clean, accurate records:

-

Payroll data processed directly in QBO

-

Journal entries and manual adjustments

-

Reimbursements, deposits, and non-project transactions

-

Custom fields unique to either system

-

Attachments — files and documents do not sync between Ressio and QBO

Best Practices for Accountants

✅ Keep QuickBooks as your source of truth for accounting.

Perform reconciliations, payments, and reporting in QBO while using Ressio for job-level tracking.

✅ Map Cost Codes carefully.

Ensure each Ressio Cost Code links to the correct Product & Service in QBO before creating client invoices or bills.

✅ Sync after major updates.

When adding vendors, customers, or tax codes in QBO, run a manual sync to update Ressio.

✅ Review sync logs regularly.

Under Company Settings → Integrations → QuickBooks Online, confirm sync success and check for any skipped items.

✅ Use consistent naming conventions.

Maintain identical names for customers, vendors, and projects in both systems. This prevents duplicate records and improves reporting accuracy.

⚠️ Common Mistake

When recording Bills or Expenses in QuickBooks Online, avoid using the Category field.

Only Items (Products & Services) will sync correctly with Ressio Cost Codes.

Using Categories prevents transactions from linking to the mapped cost codes in Ressio, which can lead to missing or inaccurate job cost data.

If you have any questions or need further assistance, contact our support team at support@ressiosoftware.com. We're here to help!